← tax on non qualified dividends Qualified dividends ordinary vs finance basics corporate regenerative nodules in liver cirrhosis ct scan Nodules regenerative infarcted liver variceal findings bleeding fate septic →

If you are looking for How to Pay No Tax on Your Dividend Income - Retire by 40 you've came to the right place. We have 35 Pics about How to Pay No Tax on Your Dividend Income - Retire by 40 like Qualified Dividends: Definition and Tax Advantages, How Are Dividends Taxed? 2023 & 2024 Dividend Tax Rates | The Motley Fool and also How Are Dividends Taxed? 2023 & 2024 Dividend Tax Rates | The Motley Fool. Here it is:

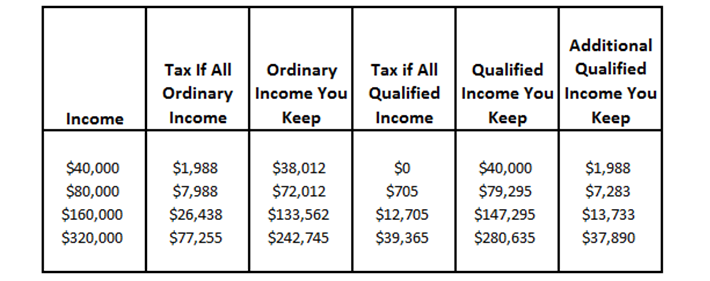

How To Pay No Tax On Your Dividend Income - Retire By 40

retireby40.org

retireby40.org

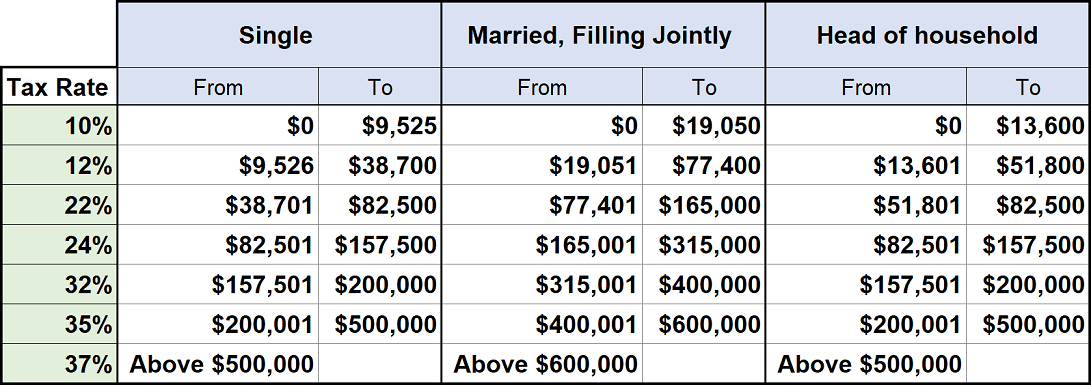

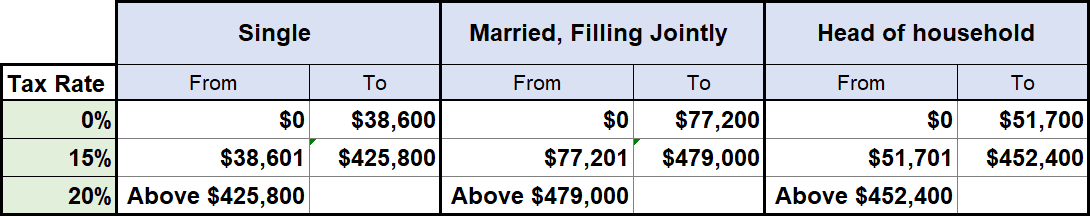

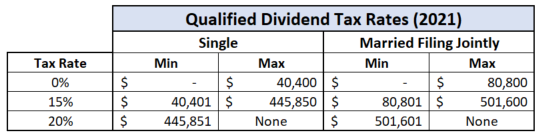

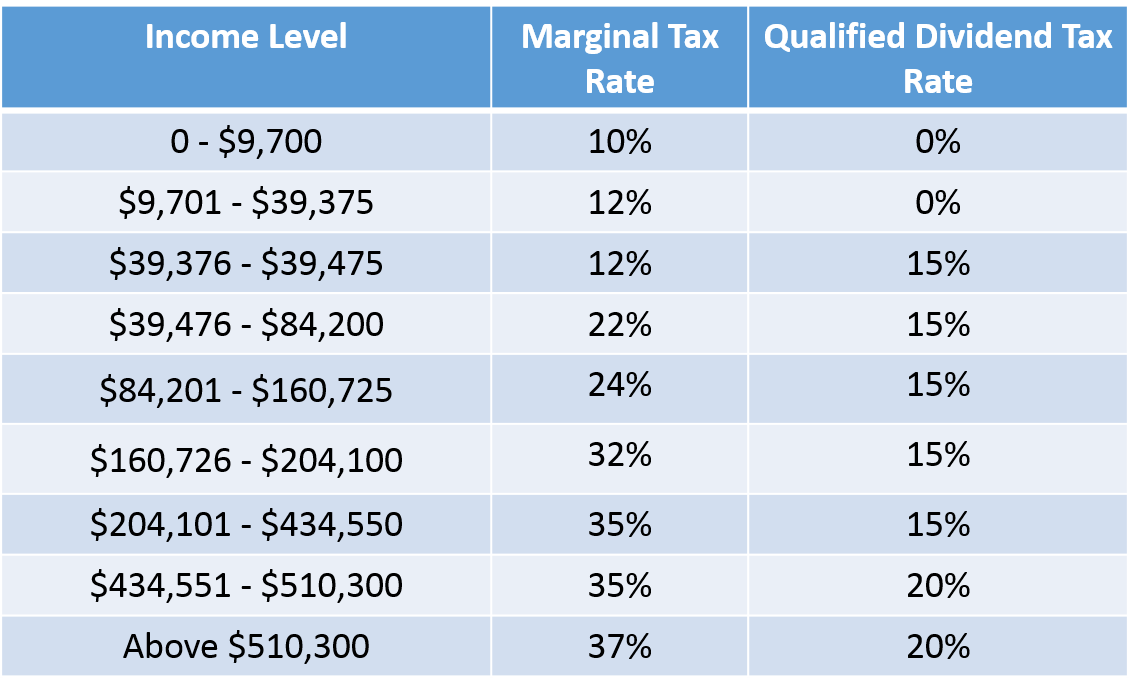

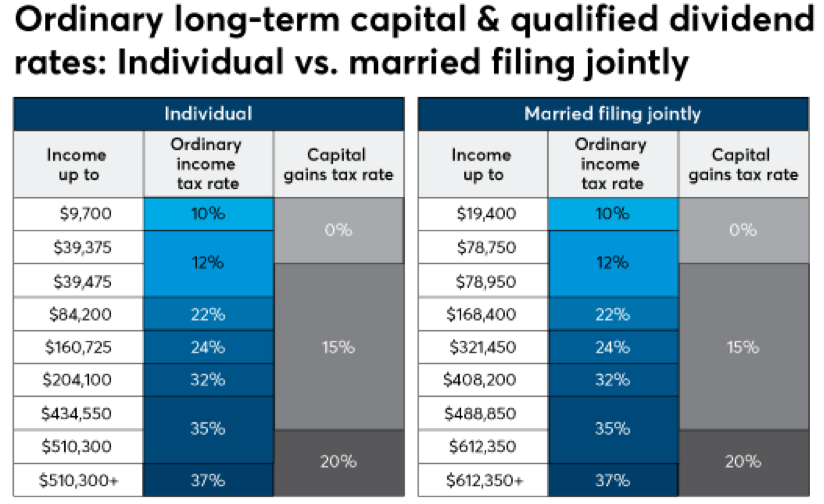

tax dividend income pay rate capital gain bracket term long table here important thing note re if

Cash Dividends – Defined And Explained - DividendInvestor.com

www.dividendinvestor.com

www.dividendinvestor.com

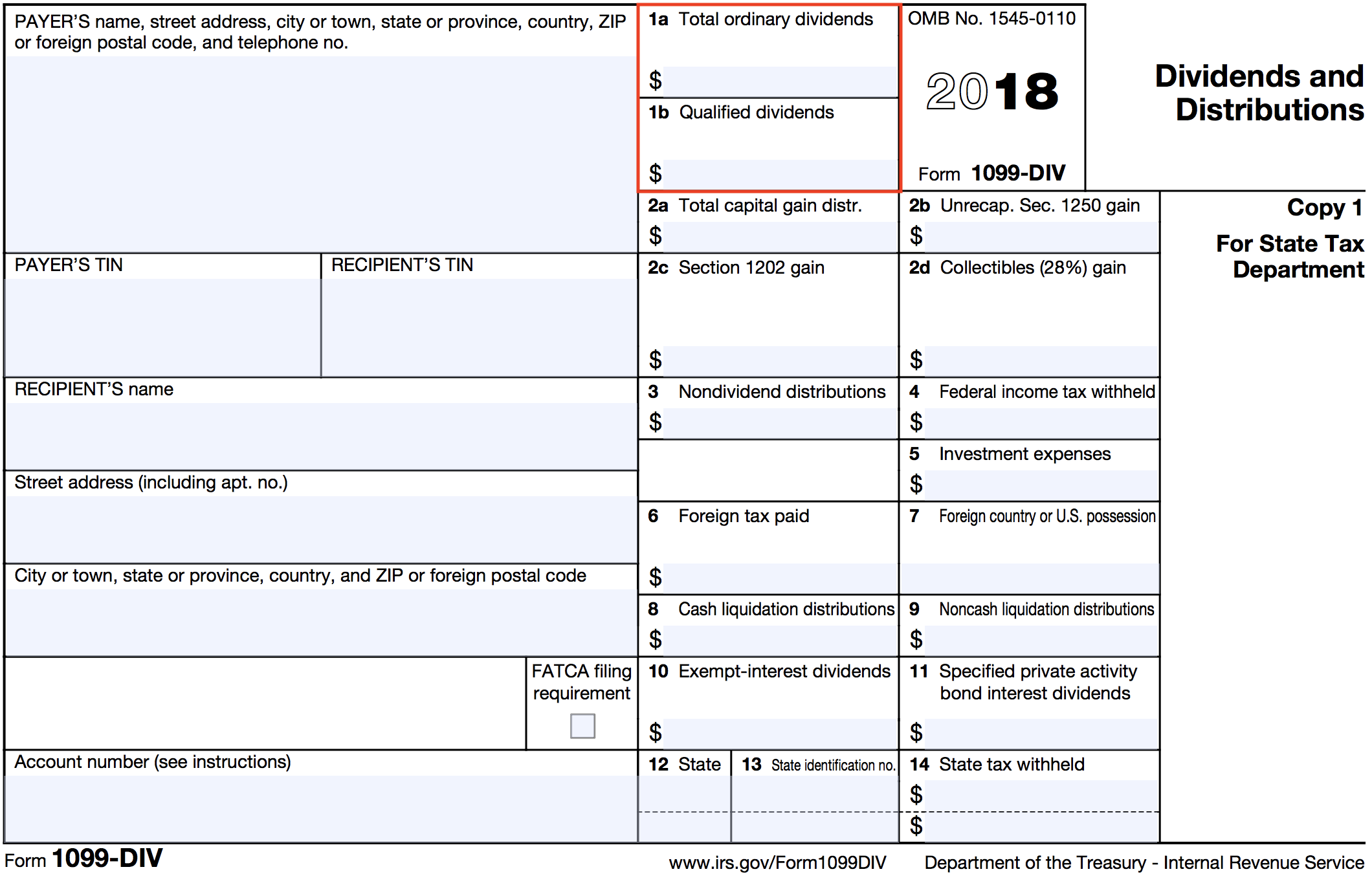

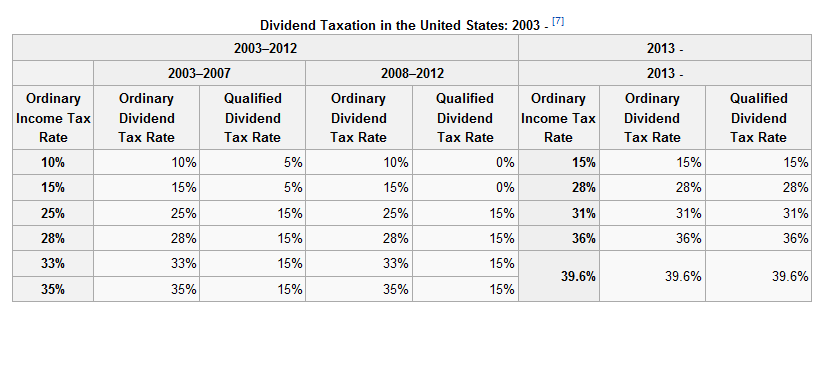

dividends cash tax ordinary rates explained defined income table

Qualified Dividends: Definition And Tax Advantages - Intelligent Income

www.simplysafedividends.com

www.simplysafedividends.com

dividends qualified tax definition irs income advantages source

Ordinary Dividends, Qualified Dividends, Return Of Capital: What Does

www.suredividend.com

www.suredividend.com

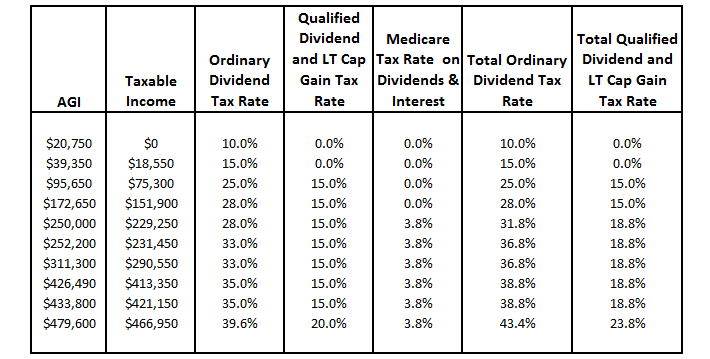

qualified ordinary dividends tax dividend income rates capital taxable return brackets versus based author source suredividend

Am I Taxed On Stock Dividends - Good Fun Site Art Gallery

kstreetchronicles.blogspot.com

kstreetchronicles.blogspot.com

How Are Dividends Taxed? - DividendInvestor.com

www.dividendinvestor.com

www.dividendinvestor.com

dividends taxed qualified rates tax dividend ordinary non table income brackets versus gains capital difference they below definitions year shown

Tax Rate On Qualified Dividends: A Comprehensive Guide | TAXGURO

www.philippinetaxationguro.com

www.philippinetaxationguro.com

Qualified Dividends Are Your Way To Minimize Tax On Reinvested Dividends!

einvestingforbeginners.com

einvestingforbeginners.com

qualified dividends dividend reinvested minimize

How Are Dividends Taxed? 2023 & 2024 Dividend Tax Rates | The Motley Fool

www.fool.com

www.fool.com

How Dividend Reinvestments Are Taxed

simplysafedividends.com

simplysafedividends.com

Repeal Of Interest And Dividends Tax Disproportionately Benefits

newhampshirebulletin.com

newhampshirebulletin.com

How Much You'll Save With The Dividend Tax Credit

www.moneysense.ca

www.moneysense.ca

dividend stocks investing moneysense

Qualified Dividend Requirements - Its Advantages & Example | EFM

efinancemanagement.com

efinancemanagement.com

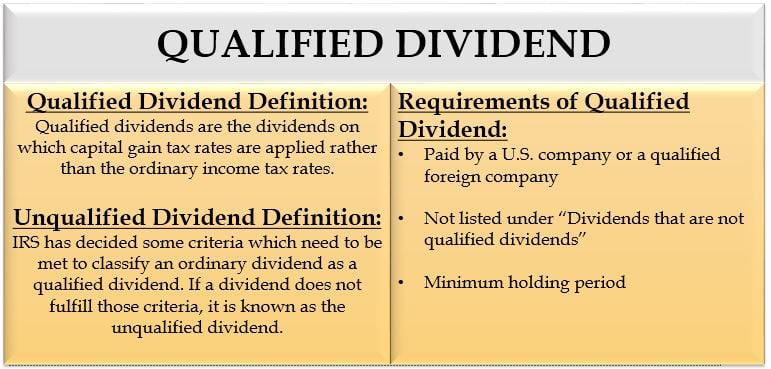

qualified dividend dividends tax ordinary capital efinancemanagement income gain rates decisions definition policy company gains which article

Qualified Dividends: Definition And Tax Advantages - Intelligent Income

www.simplysafedividends.com

www.simplysafedividends.com

tax dividends qualified social income definition affect benefits security do rate marketwatch source

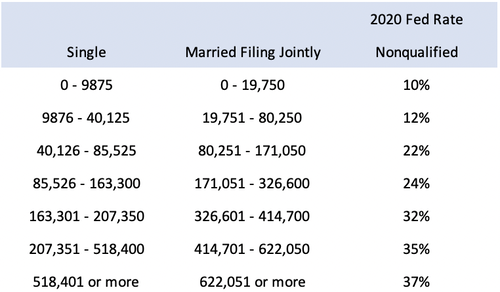

Tax Basics - WES

findwes.com

findwes.com

tax basics dividends qualified brackets

T22-0230 - Tax Benefit Of The Preferential Rates On Long-Term Capital

www.taxpolicycenter.org

www.taxpolicycenter.org

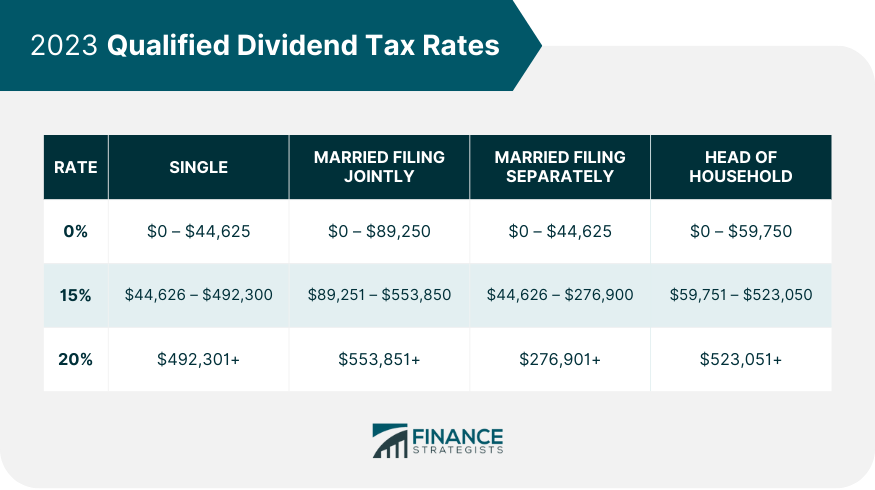

Qualified Dividend Tax Planning | Definition & Strategies

www.financestrategists.com

www.financestrategists.com

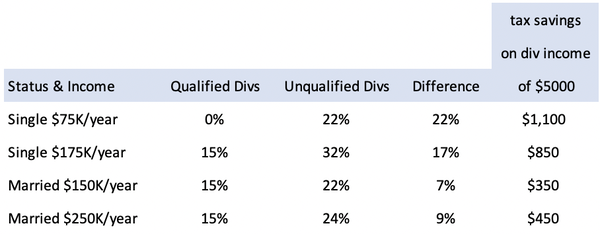

Qualified Dividends

www.borntosell.com

www.borntosell.com

dividends qualified tax vs unqualified single savings married examples paid if so

Ordinary Dividends, Qualified Dividends, Return Of Capital: What Does

seekingalpha.com

seekingalpha.com

qualified dividends ordinary

Qualified Dividends

www.borntosell.com

www.borntosell.com

qualified dividends brackets tax federal rates pay course different here

Qualified Dividends And Capital Gain Tax Worksheet Line 16 2

classzoneintuitive.z13.web.core.windows.net

classzoneintuitive.z13.web.core.windows.net

How To Report Dividend Income On The 2022 Federal Income Tax Return

www.myfederalretirement.com

www.myfederalretirement.com

40 Qualified Dividends And Capital Gain Tax Worksheet - Worksheet Master

gersgiasbwa.blogspot.com

gersgiasbwa.blogspot.com

Are Your Dividends Qualified Or Ordinary? | Beacon

U.S. Dividends And The Capital Gains Tax Rate Since 1961 | Seeking Alpha

seekingalpha.com

seekingalpha.com

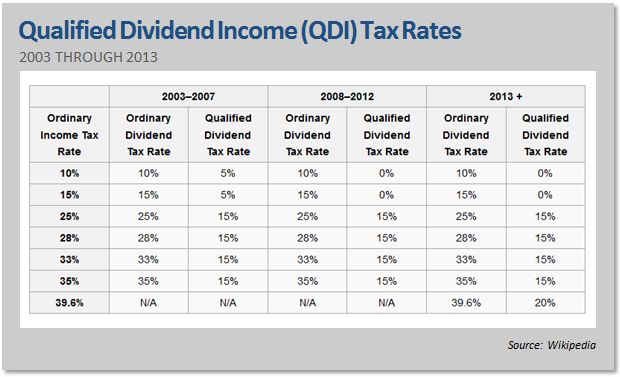

tax dividend rates rate dividends gains capital current income expected snapshots future 1961 since wikipedia source onward law cartoon 2011

New Dividend Tax Rates Alert! Revealing The PAYE Code Surprise

www.wellersaccountants.co.uk

www.wellersaccountants.co.uk

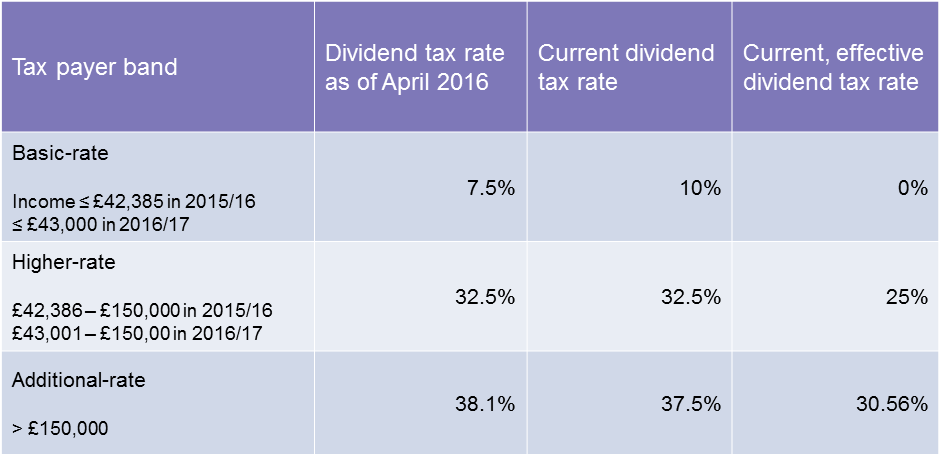

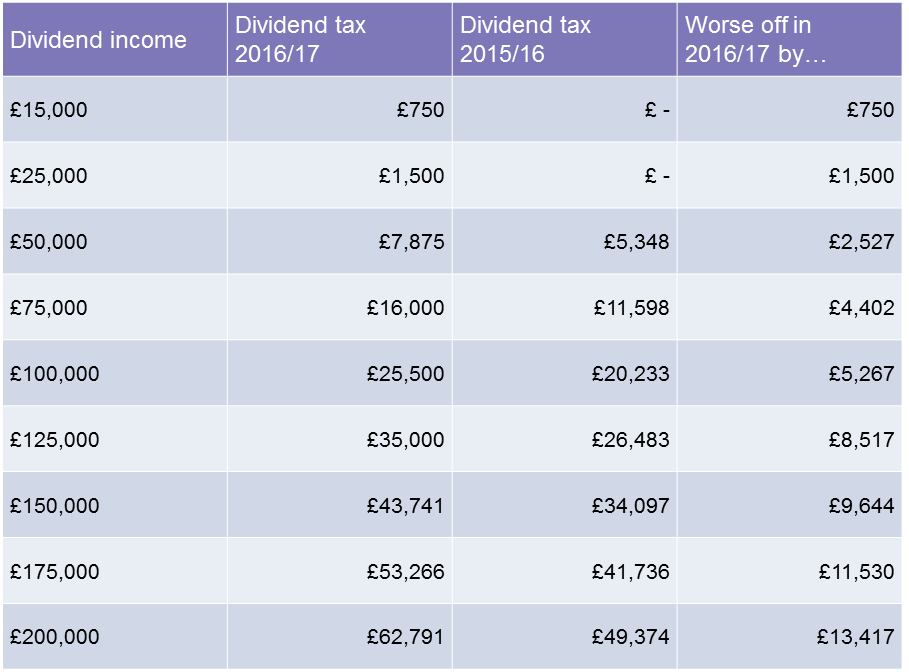

tax dividend rates rate paye surprise code revealing alert do comparison

Don’t Forget Taxes When Comparing Dividend Yields | CFA Institute

blogs.cfainstitute.org

blogs.cfainstitute.org

tax dividend income taxes federal rate vs qualified rates yields forget comparing when investor additional don note there may non

UK Dividend Tax Rates And Thresholds 2021/22 - FreeAgent

www.freeagent.com

www.freeagent.com

dividend rates freeagent

Consider Taxes In Your Investment Strategy | Rodgers & Associates

rodgers-associates.com

rodgers-associates.com

qualified dividend investments rodgers efficient kitces taxes planning should michael source

Beware! Your Dividend Tax Rate Is Changing, Here's What You Need To Know

www.wellersaccountants.co.uk

www.wellersaccountants.co.uk

tax dividend beware notional calculated

Qualified Dividends - Definition, Requirements, Tax Rates, Examples

www.wallstreetmojo.com

www.wallstreetmojo.com

Qualified Dividends (Definition, Example) | How Do They Work?

www.wallstreetmojo.com

www.wallstreetmojo.com

dividends qualified ordinary dividend income calculate unqualified

How To Avoid Short Term Capital Gains - Treatbeyond2

Qualified Dividends: Definition And Tax Advantages

1.simplysafedividends.com

1.simplysafedividends.com

qualified dividends dividend tax taxes irs simply safe source simplysafedividends

What Is A Qualified Dividend? | Tax Rates Until 2025 - Investing

www.investing.com

www.investing.com

Qualified dividends: definition and tax advantages. Don’t forget taxes when comparing dividend yields. Tax dividend income pay rate capital gain bracket term long table here important thing note re if