← what is the tax on qualified dividends Qualified dividend face efinancemanagement example tax rates for qualified dividends Qualified dividends (definition, example) →

If you are searching about Qualified vs Ordinary Dividends | Top 3 Differences (With Infographics) you've visit to the right web. We have 35 Images about Qualified vs Ordinary Dividends | Top 3 Differences (With Infographics) like Qualified vs Non-Qualified Dividends and why you should care (think, Tax Basics - WES and also Qualified dividends. Here it is:

Qualified Vs Ordinary Dividends | Top 3 Differences (With Infographics)

www.educba.com

www.educba.com

qualified dividends ordinary vs finance basics corporate

Qualified Dividends

www.borntosell.com

www.borntosell.com

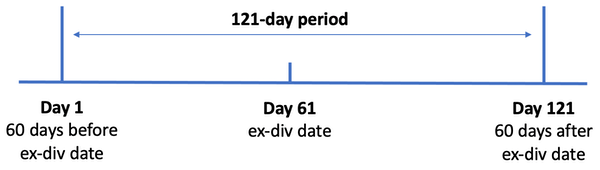

dividends qualified unqualified dividend period holding example

What Are Qualified Dividends, And How Are They Taxed?

:max_bytes(150000):strip_icc()/TermDefinitions_Qualifieddividend-edit-e562d9d55b3c4f24b2dc11afc1adff04.jpg) www.investopedia.com

www.investopedia.com

57.1% TAX Savings - Qualified Vs Non-qualified Dividends (SCHD, JEPI

www.youtube.com

www.youtube.com

Qualified Versus Non-Qualified Dividends – What Is The Difference

www.dividendinvestor.com

www.dividendinvestor.com

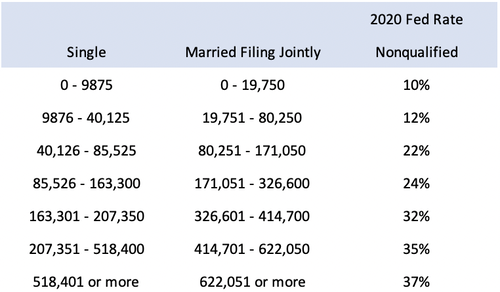

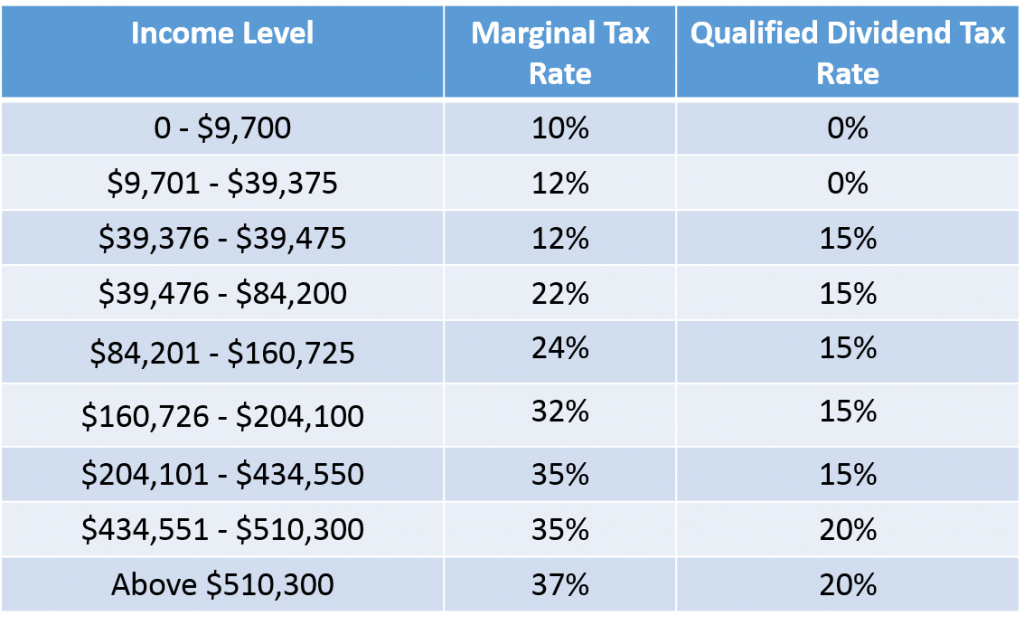

dividends qualified taxed rates tax dividend non ordinary table versus income brackets gains capital difference they definitions below year

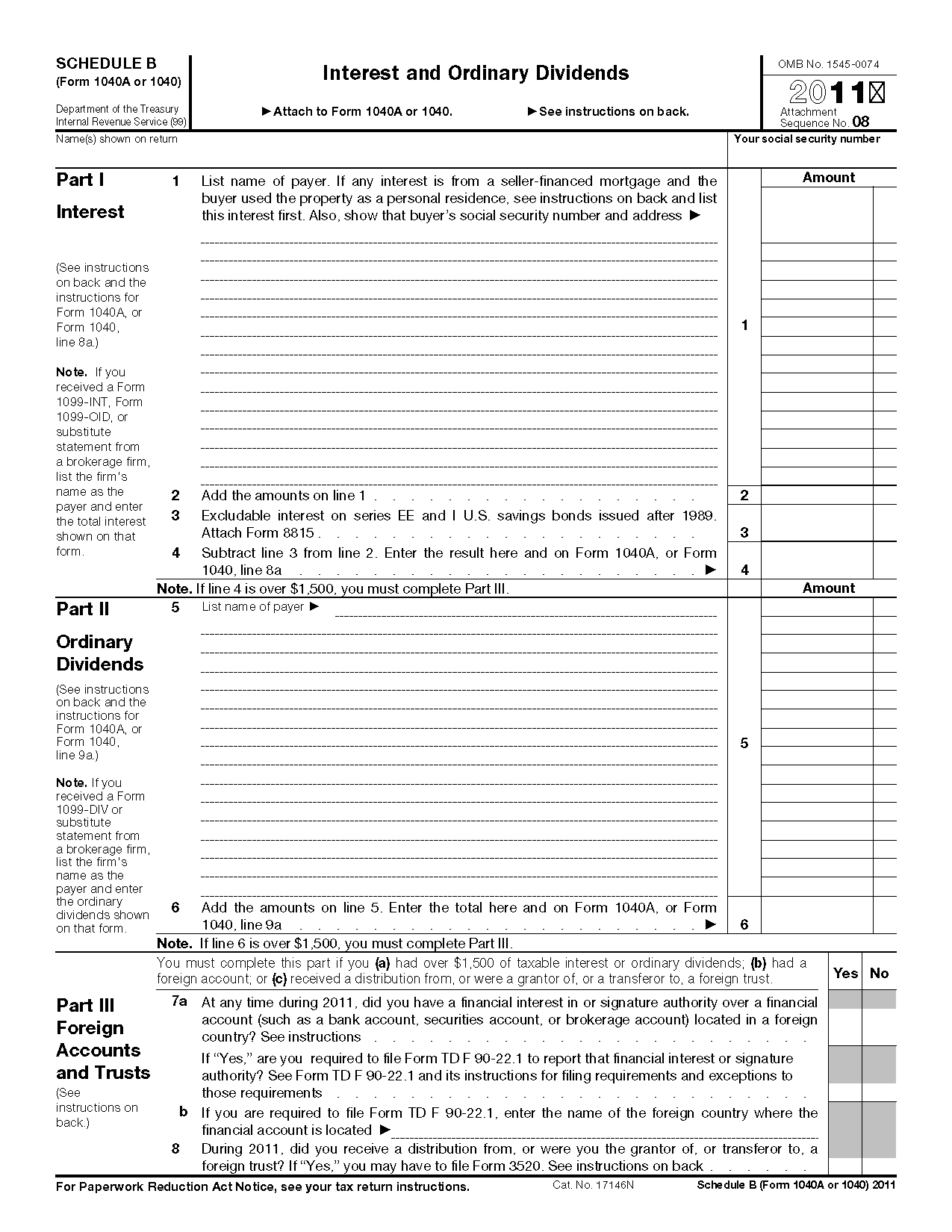

Irs Form Schedule B Printable - Printable Forms Free Online

printableformsfree.com

printableformsfree.com

How To Get Qualified Tax Treatment For Your Dividends, My Take

inflationhedging.com

inflationhedging.com

tax dividends qualified dividend income federal rate taxes vs rates treatment yields reit investor get comparing forget when never why

How Non-qualified Dividends Are Taxes - YouTube

www.youtube.com

www.youtube.com

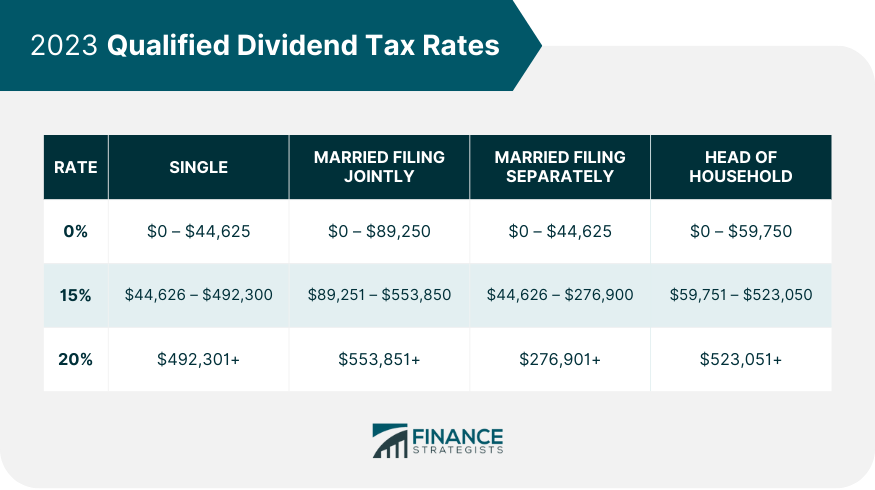

Qualified Dividend Tax Planning | Definition & Strategies

www.financestrategists.com

www.financestrategists.com

Qualified Dividends: Definition And Tax Advantages - Intelligent Income

www.simplysafedividends.com

www.simplysafedividends.com

dividends qualified tax definition irs income advantages source

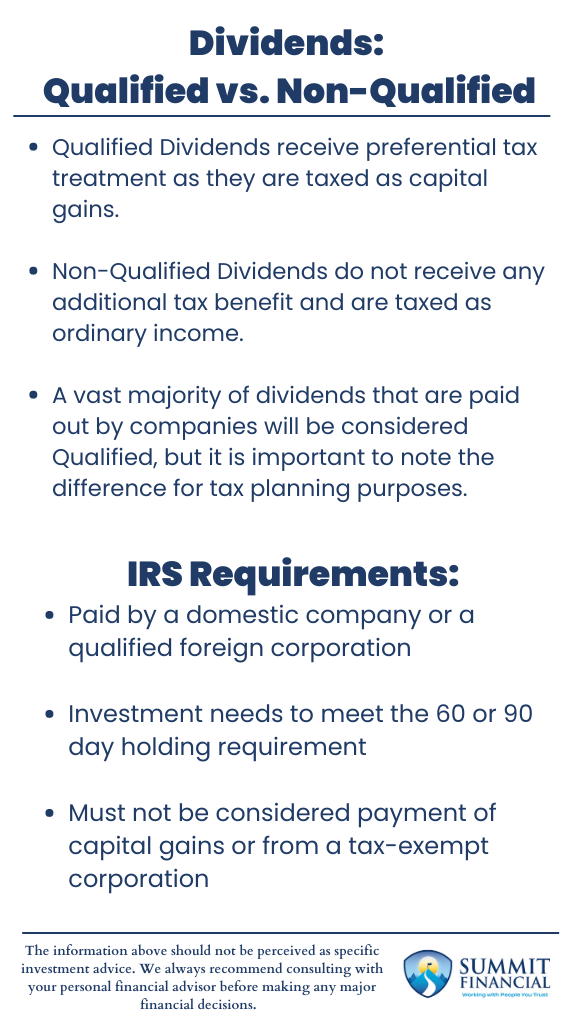

Understanding Dividends: Qualified Vs. Non-Qualified

summitfc.net

summitfc.net

Qualified Vs. Non-Qualified Dividends: What's The Difference?

finance.yahoo.com

finance.yahoo.com

Are Your Dividends Qualified Or Ordinary? | Beacon

How Are Dividends Taxed (Qualified, Nonqualified, International) - YouTube

www.youtube.com

www.youtube.com

dividends qualified taxed

Qualified Dividends

www.borntosell.com

www.borntosell.com

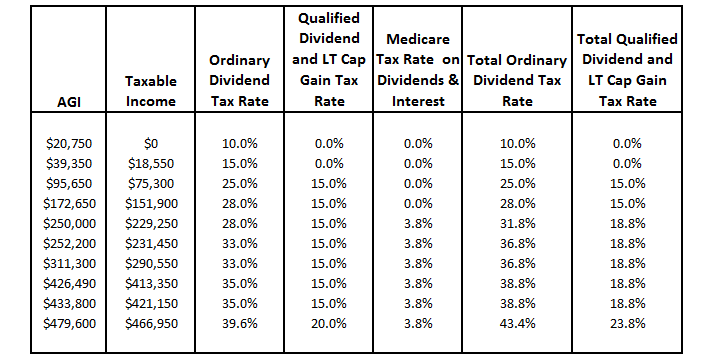

qualified dividends brackets tax federal rates pay course different here

Dividend Tax Rates 2024/25 Uk - Taffy Federica

alverayzulema.pages.dev

alverayzulema.pages.dev

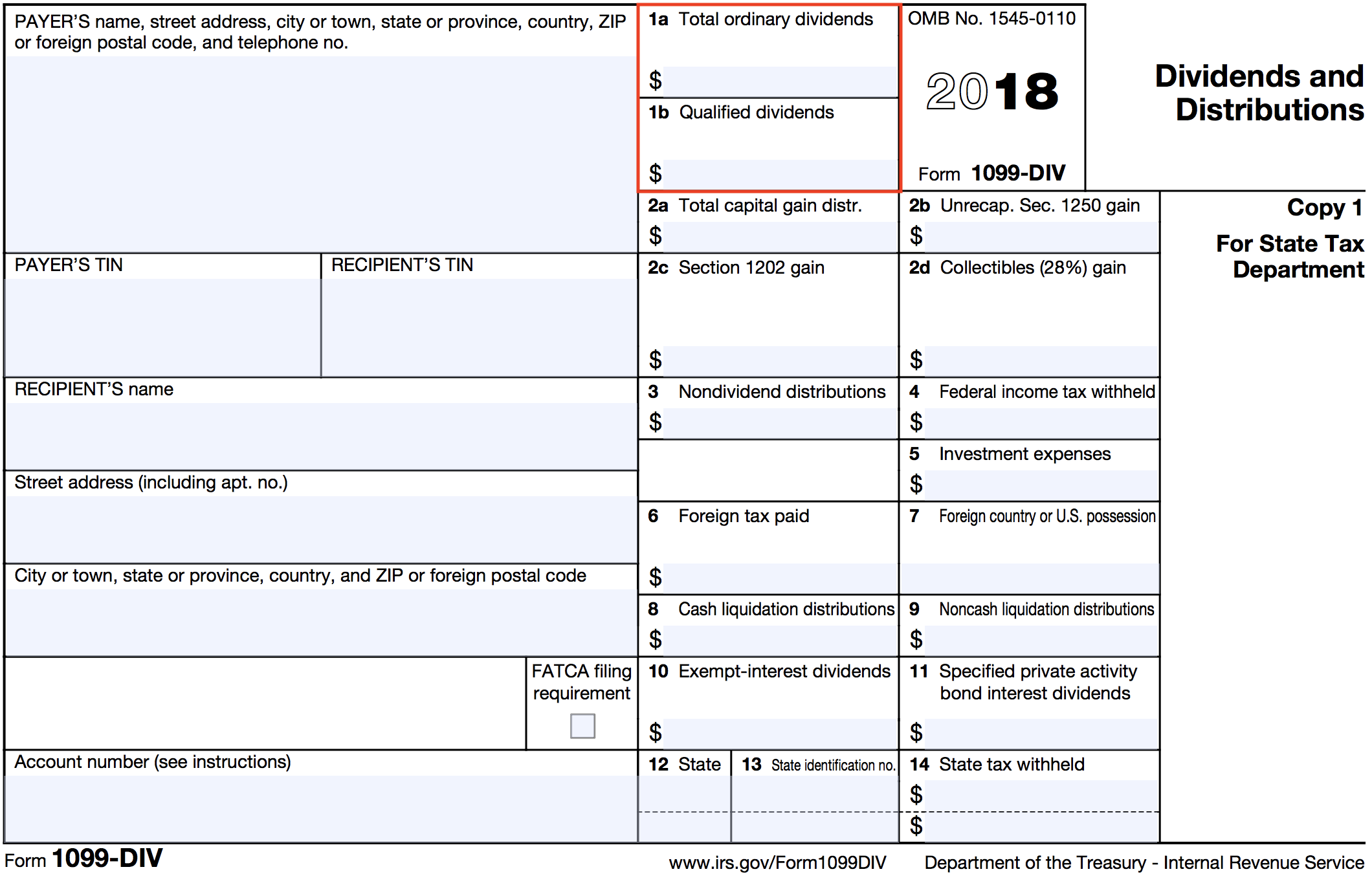

How To Report Dividend Income On The 2022 Federal Income Tax Return

www.myfederalretirement.com

www.myfederalretirement.com

Qualified Dividends - Definition, Requirements, Tax Rates, Examples

www.wallstreetmojo.com

www.wallstreetmojo.com

What Is A Qualified Dividend? | Tax Rates Until 2025 - Investing

www.investing.com

www.investing.com

How Are Dividends Taxed? 2023 & 2024 Dividend Tax Rates | The Motley Fool

www.fool.com

www.fool.com

Qualified Dividends Vs. Non Qualified Dividends - YouTube

www.youtube.com

www.youtube.com

Qualified Dividends: Definition And Tax Advantages - Intelligent Income

www.simplysafedividends.com

www.simplysafedividends.com

tax dividends qualified social income definition affect benefits security do rate marketwatch source

Ordinary Dividends, Qualified Dividends, Return Of Capital: What Does

seekingalpha.com

seekingalpha.com

Qualified Dividends Vs. Non-Qualified Dividends - ACap Advisors

www.acapam.com

www.acapam.com

Qualified Dividends Are Your Way To Minimize Tax On Reinvested Dividends!

einvestingforbeginners.com

einvestingforbeginners.com

qualified dividends dividend reinvested minimize

Qualified Dividends

www.borntosell.com

www.borntosell.com

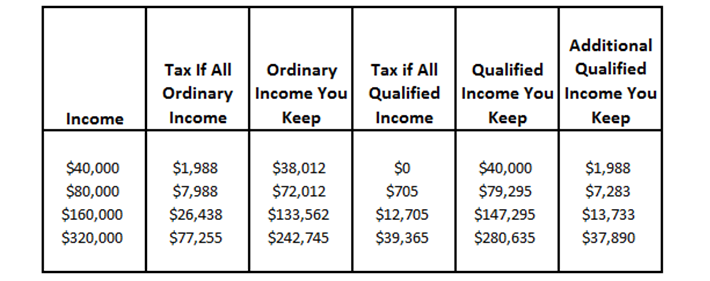

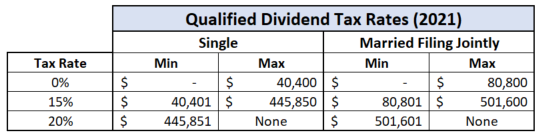

dividends qualified tax vs unqualified single savings married examples paid if so

Best Tax Breaks: 12 Most-Overlooked Tax Breaks & Deductions (2021)

lyfeaccounting.com

lyfeaccounting.com

income breaks taxes married overlooked deductions filing limits filers taxable

Tax Basics - WES

findwes.com

findwes.com

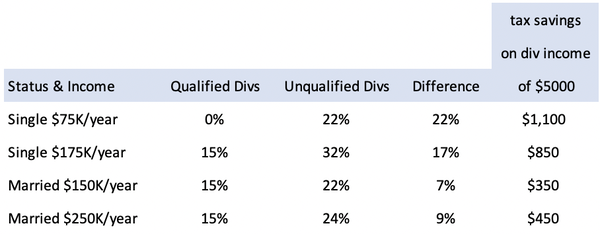

tax dividends qualified bracket brackets marginal

Qualified Dividends: Definition And Tax Advantages

research.simplysafedividends.com

research.simplysafedividends.com

qualified dividends dividend tax taxes irs simply safe source simplysafedividends

Tax Sheltered Annuity Taxation - Berry Nielsen

moob-813b.blogspot.com

moob-813b.blogspot.com

Qualified Dividends Taxed As Capital Gains

worksheetstinifloclaniv9.z21.web.core.windows.net

worksheetstinifloclaniv9.z21.web.core.windows.net

Qualified Vs Non-Qualified Dividends And Why You Should Care (think

www.youtube.com

www.youtube.com

Qualified Dividends (Definition, Example) | How Do They Work?

www.wallstreetmojo.com

www.wallstreetmojo.com

dividends qualified ordinary dividend income calculate unqualified

Tax Benefits Of Qualified Dividends - Guide With Examples - TheStreet

www.thestreet.com

www.thestreet.com

How Dividend Reinvestments Are Taxed

simplysafedividends.com

simplysafedividends.com

Tax dividends qualified social income definition affect benefits security do rate marketwatch source. How to report dividend income on the 2022 federal income tax return. Tax dividends qualified dividend income federal rate taxes vs rates treatment yields reit investor get comparing forget when never why