← workplace transport risk assessment hse Risk assessment template management plan project templates manufacturing example fire excel sheet health questionnaire sample examples table property construction schools adjusted gross income Download adjusted gross income calculator excel template →

If you are searching about T22-0250 - Tax Benefit of the Earned Income Tax Credit (EITC), Baseline you've visit to the right page. We have 35 Pics about T22-0250 - Tax Benefit of the Earned Income Tax Credit (EITC), Baseline like Eligible Taxpayers Can Claim Earned Income Tax Credit (EITC), Earned Income Tax Credit | City of Detroit and also Earned Income Tax Credit Flow Chart. Read more:

T22-0250 - Tax Benefit Of The Earned Income Tax Credit (EITC), Baseline

www.taxpolicycenter.org

www.taxpolicycenter.org

Earned Income Tax Credit & All It’s Details | AOTAX.COM

www.aotax.com

www.aotax.com

income earned tax credit details credits

Maximize Your Tax Refund With The Earned Income Tax Credit

handsaccounting.com

handsaccounting.com

Earned Income Tax Credit | CowderyTax.com

cowderytax.com

cowderytax.com

What Is The Earned Income Tax Credit? | Tax Policy Center

www.taxpolicycenter.org

www.taxpolicycenter.org

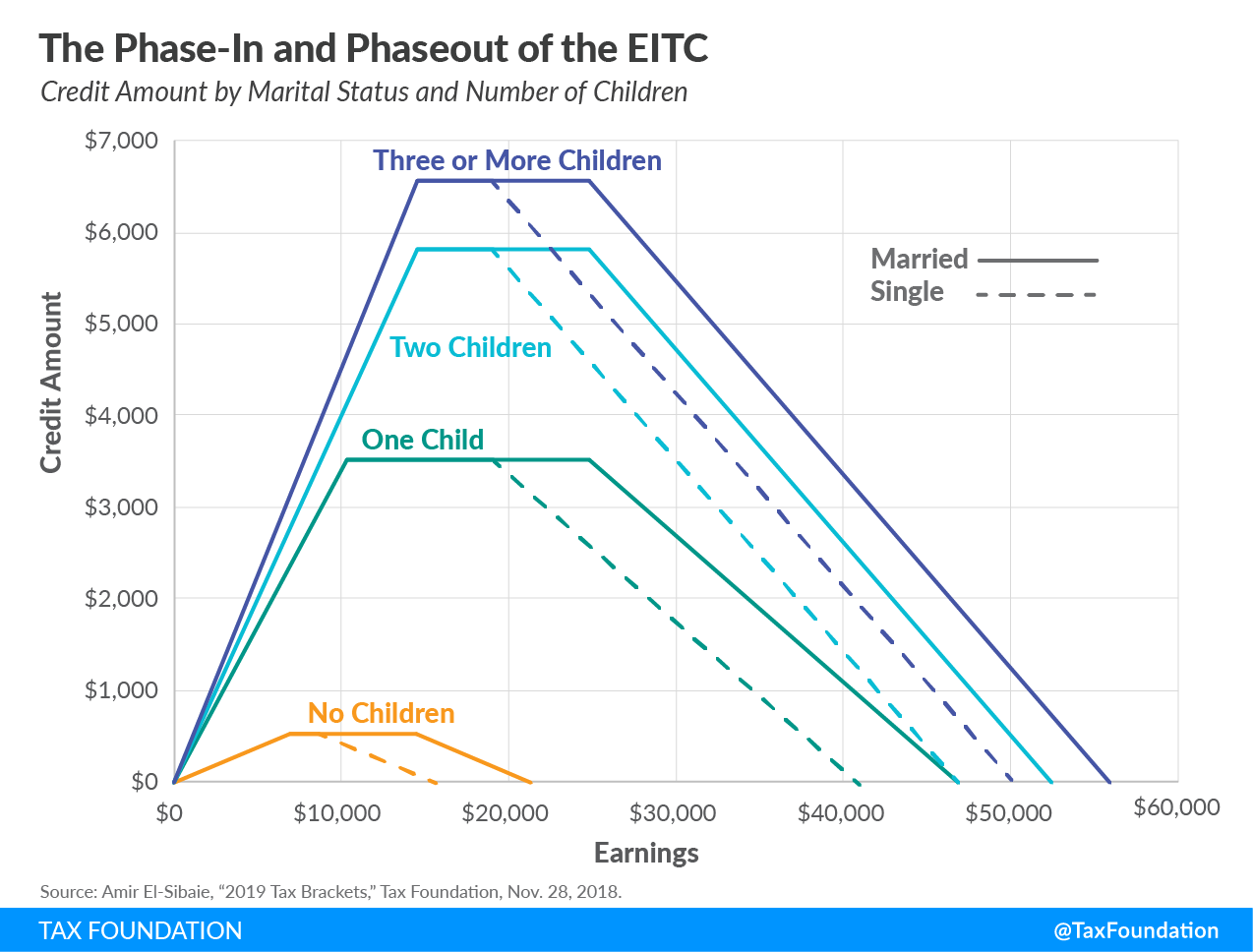

earned maximum phaseout

All About The Earned Income Tax Credit « Strategic Tax Planning

www.mstiller.com

www.mstiller.com

income earned credit tax form if eic 1040 qualify ll

Mayor Urges Detroit Residents To Seek Tax Refunds | WDET

wdet.org

wdet.org

tax detroit earned income seek refunds residents urges mayor city wdet courtesy

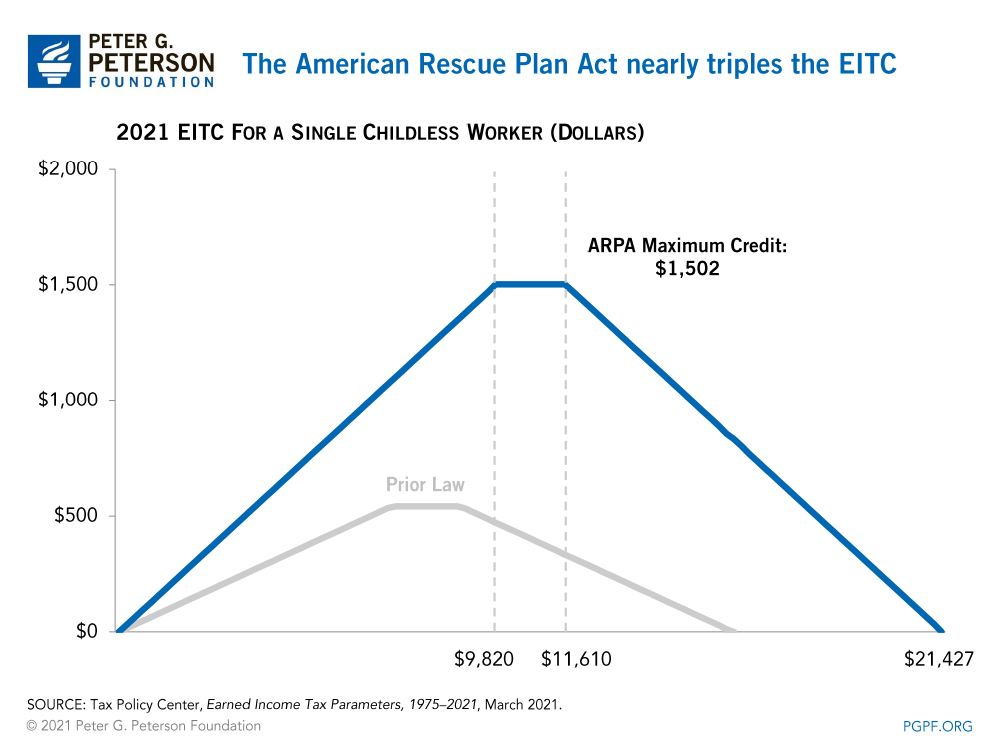

What Is The Earned Income Tax Credit?

www.pgpf.org

www.pgpf.org

earned eitc chart eligibility

Can A Single Person Get The Earned Income Credit? Leia Aqui: What Is

fabalabse.com

fabalabse.com

The Success Of The Earned Income Tax Credit | Econofact

econofact.org

econofact.org

income tax earned credit success eitc issue

2020 Form IRS 1040 - Schedule EIC Fill Online, Printable, Fillable

eic-form.pdffiller.com

eic-form.pdffiller.com

earned eic 1040 irs schedule pdffiller

Earned Income Tax Credit | Dayton, OH

income tax credit earned eitc child gov

Earned Income Tax Credit (EITC) - Definition & How To Qualify - Techopedia

www.techopedia.com

www.techopedia.com

Am I Eligible For The Earned Income Tax Credit | Turbo Tax

turbo-tax.org

turbo-tax.org

earned income eligible turbo qualify

NYS Can Help Low-income Working Families With Children By Increasing

fiscalpolicy.org

fiscalpolicy.org

income earned tax table credit nys children eitc families low chart child working tables help credits increasing policy its

How To Qualify For The Earned Income Tax Credit - M&M Tax

mmtax.com

mmtax.com

Earned Income Tax Credit (EITC): A Primer | Tax Foundation

taxfoundation.org

taxfoundation.org

What Is The Earned Income Tax Credit?

www.pgpf.org

www.pgpf.org

earned eitc

What Is The Earned Income Tax Credit? Do I Qualify? - SFS Tax

sfstaxacct.com

sfstaxacct.com

tax income earned credit qualify do article

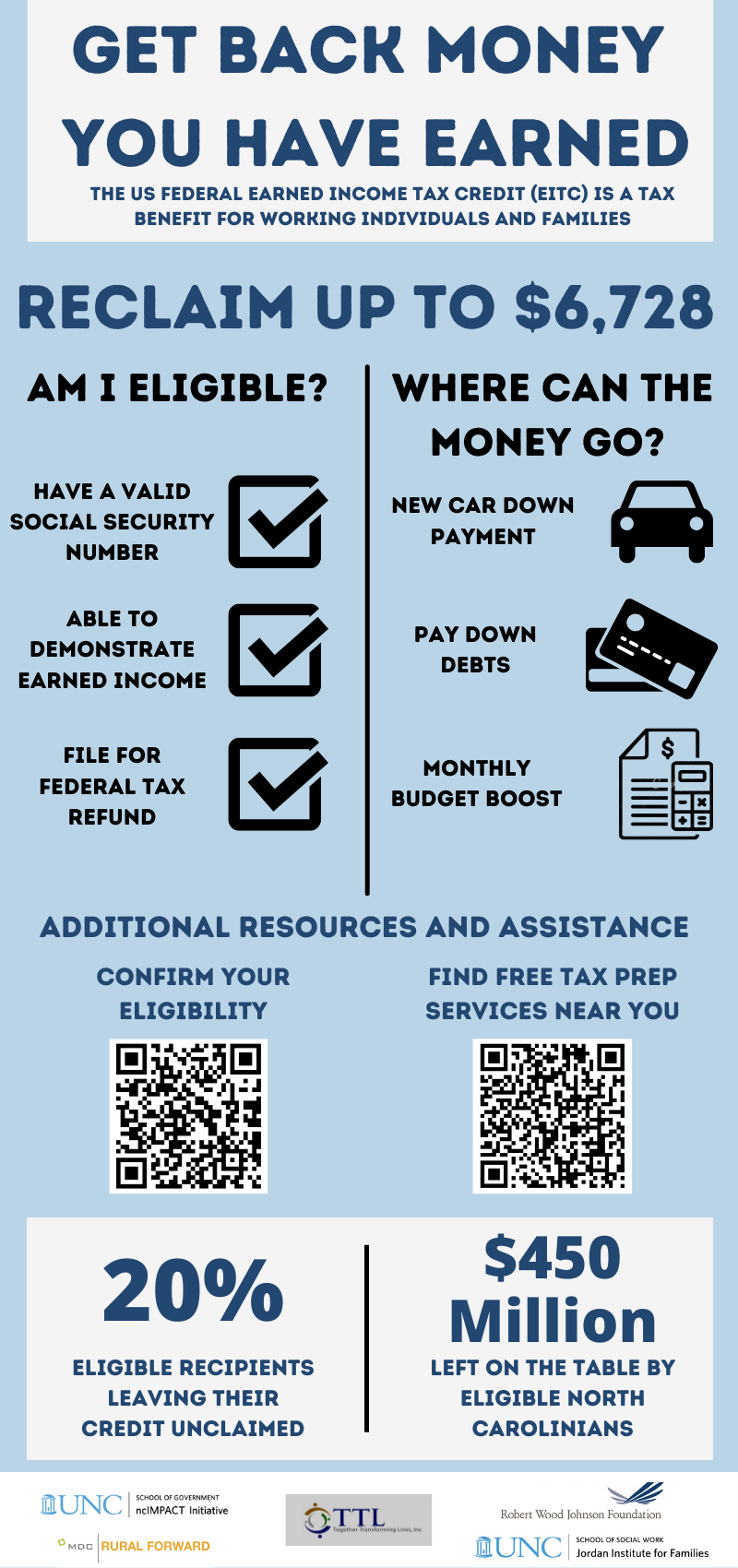

EITC (Earned Income Tax Credit) - NcIMPACT Initiative

ncimpact.sog.unc.edu

ncimpact.sog.unc.edu

Earned Income Tax Credit - Crowe-Mallette & Associates

cmacpa.net

cmacpa.net

income earned eitc moderate families workers

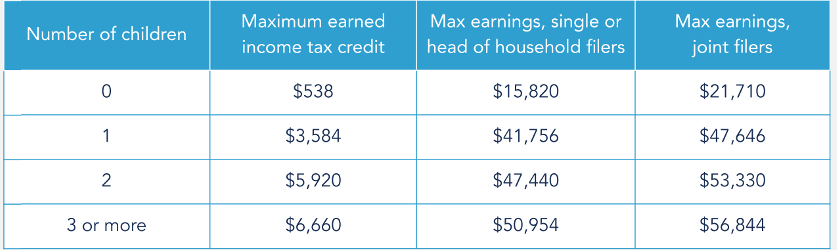

Earned Income Tax Credit - What You Need To Know

youngandtheinvested.com

youngandtheinvested.com

income earned credit tax table qualifications limits much know qualifies who

The Earned Income Tax Credit (EITC): Who Qualifies And What Not To Do

www.keepertax.com

www.keepertax.com

Earned Income Tax Credit Awareness Day 2024 (US): Activities, History

newsd.in

newsd.in

Earned Income Tax Credit (EITC) | BenefitsFinder.com

benefitsfinder.com

benefitsfinder.com

Eligible Taxpayers Can Claim Earned Income Tax Credit (EITC)

www.aarp.org

www.aarp.org

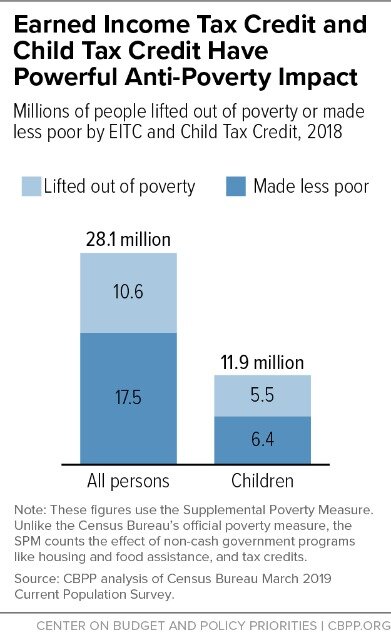

Why We Should Expand The Earned Income Tax Credit | Prosperity Now

prosperitynow.org

prosperitynow.org

earned tax income credit expand families working should why expands credits act relief dramatically share prosperitynow

Do You Qualify For The Earned Income Tax Credit? | Sapling

www.sapling.com

www.sapling.com

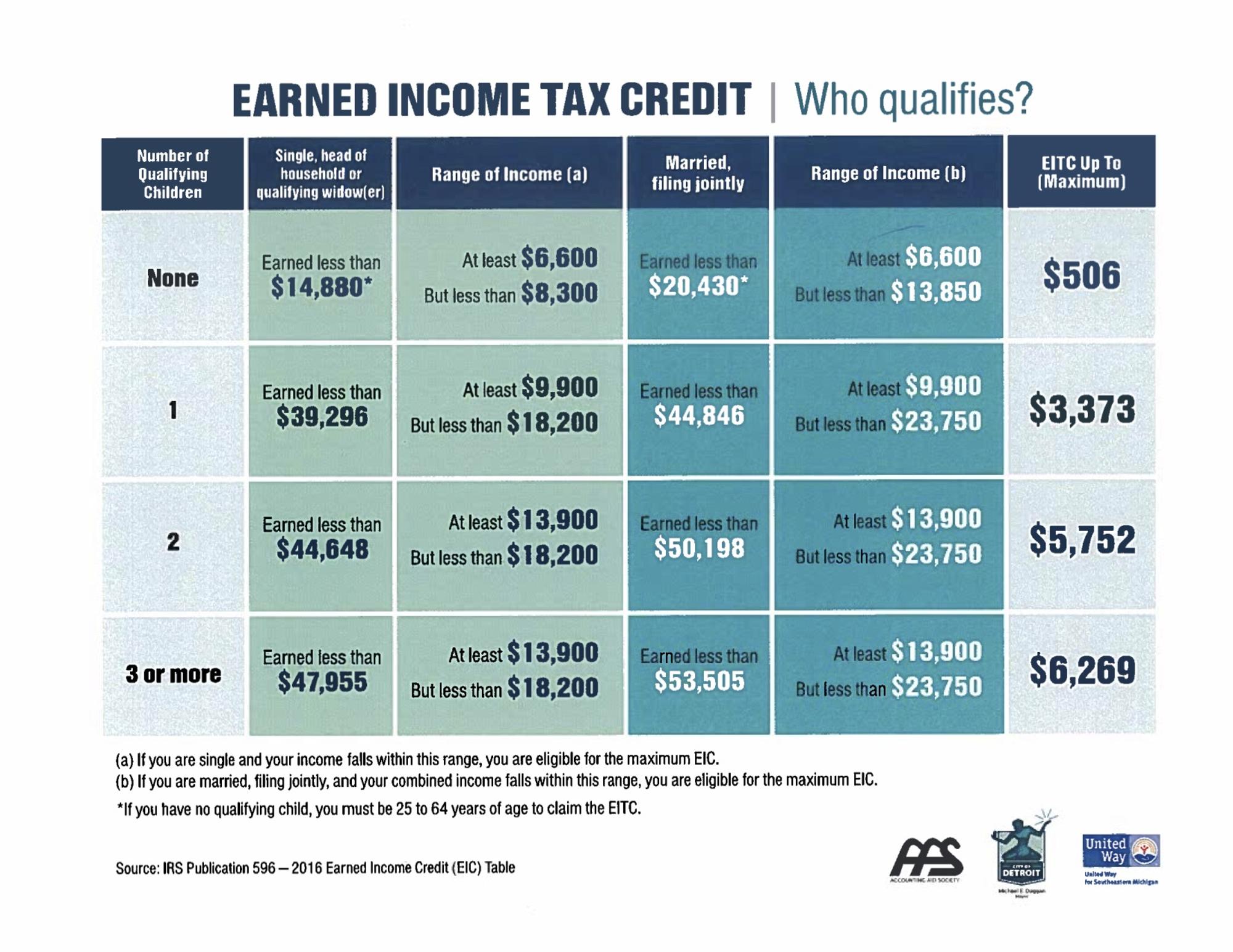

Earned Income Tax Credit | City Of Detroit

detroitmi.gov

detroitmi.gov

income tax earned credit chart qualify household limit children filing working varies depending status number detroitmi

Astounding Gallery Of Eic Tax Table Concept | Turtaras

turtaras.blogspot.com

turtaras.blogspot.com

Earned Income Tax Credit 2024 - Federal Tax Credits

www.taxuni.com

www.taxuni.com

earned bills retirement fatture dollaro soldi tiene mano supplement hoff masking earnings retire generic derived taxuni

Earned Income Tax Credit (EITC) & Child Tax Credit (CTC) | ACCESS

www.accesscommunity.org

www.accesscommunity.org

tax earned income credit eitc spouse qualifying security return must child social each any number list

Earned Income Tax Credit: What It Is, How Much It’s Worth | Fidelity

www.fidelity.com

www.fidelity.com

Earned Income Tax Credit Flow Chart

mungfali.com

mungfali.com

All About The Earned Income Tax Credit | Account-Abilities LLC

accountabilitiesllc.com

accountabilitiesllc.com

income earned tax credit 1040 eic form lines foreign exclusion

Maximize your tax refund with the earned income tax credit. Earned eic 1040 irs schedule pdffiller. Do you qualify for the earned income tax credit?